Blogs

Commercial angling has got the foundation of the fresh economy to possess several urban centers to the island in addition to Craig, Klawock, Hydaburg, Vent Protection and you can Part Baker. During the summer, trollers and seiners one another catch all the four species of Pacific fish. Dungeness crab and you may shrimp season is actually unlock all year long. During the winter you’ll find diving fisheries to have geoducks, sea cucumbers, and you can sea urchins. Look at the compatible package online 15 to share with you and this option you decide on.

See out of 2025 Annual Fulfilling from Shareholders

- Most clients take-home somewhere within fifty and you will a hundred weight from fish of 5 or more days of charters, which is not counting fishing they actually do by themselves.

- Mode 720 must be signed by a person authorized by the organization to help you signal it go back.

- You can submit an application for a fees arrangement on the web if your full number your debt inside mutual tax, charges, and you may interest are $twenty-five,000 ($fifty,100 for individuals) or shorter, and you will you’ve registered all of the required efficiency.

- As well as withholding Medicare income tax during the step 1.45%, you should keep back a good 0.9% More Medicare Income tax of wages you have to pay to help you a member of staff inside overabundance $200,000 inside the a season.

The fresh management error adjustment corrects extent advertised to the Mode 941, Function 943, or Mode 944 in order to agree with the number indeed withheld out of group and you can advertised on the Models W-2. Liven Co. is actually a month-to-month plan depositor which have regular group. They paid earnings for every Friday throughout the March but didn’t spend one earnings while in the April.

The new Angling to your Sapsuk / Hoodoo River

Fundamentally, as the a manager, you’re also responsible to ensure that tax returns try recorded and you can places and payments are created, even if you offer that have a 3rd party to perform these types of acts. Your remain responsible if your third party doesn’t do any necessary step. More resources for the various kind of third-party payer plans, come across area 16. Essentially, because the a manager, you are responsible to ensure tax statements try filed and you will places and you can costs are created, even if you deal having a third party to execute such acts.

Such, if you buy a trips insurance coverage three months prior to your own departure and possess surely hurt each week before leaving, you might document a call cancellation claim. An average cost of cruise insurance is $453 for each and every journey, centered on our very own study out of cost for 40 sail travel insurance preparations. Such as, you can make an excellent “terminate unconditionally” claim if you’re concerned with being seasick—a reason maybe not covered by basic journey cancellation insurance. Buy it publicity after you create very first trip put or perhaps the purchase window because of it have a tendency to intimate. Travel cover for cruise trips performs just like basic travel cover.

You need to as well as document Models W-2c and W-3c to the SSA to correct societal defense and you will Medicare wages and you can https://glory-casinos.org/en-in/bonus/ fees. Do not correct wages (container step one) to your Form W-2c on the number paid in mistake. Quantity stated on the Models W-2, W-step 3, and Versions 941, Setting 943, otherwise Mode 944 may well not suits to have valid causes. Keep reconciliation so you’ll features track of as to why numbers failed to matches in case there are concerns on the Internal revenue service or even the SSA. See the Guidelines to possess Agenda D (Mode 941) if you want to determine one inaccuracies that have been due to an exchange, statutory merger, or integration. Willfully form willingly, consciously, and purposefully.

For individuals who paid off one wages that will be at the mercy of the fresh unemployment settlement laws and regulations out of a cards reduction state, the credit facing federal jobless income tax will be quicker according to the credit avoidance price for the borrowing protection condition. To learn more, comprehend the Agenda An excellent (Mode 940) recommendations otherwise go to Internal revenue service.gov. I’ve regrettably filed several sail insurance rates says lately, but We’yards so thankful I had exposure. When my dad died on the day we had been place to exit, insurance policies refunded you more $3,one hundred thousand to your journey termination. After, my partner and i checked out self-confident to own Covid-19 within the Paris right before our very own river cruise. We’d in order to terminate and you can purchase a week’s stay static in a pricey lodge, however, insurance safeguarded the complete $several,000 claim.

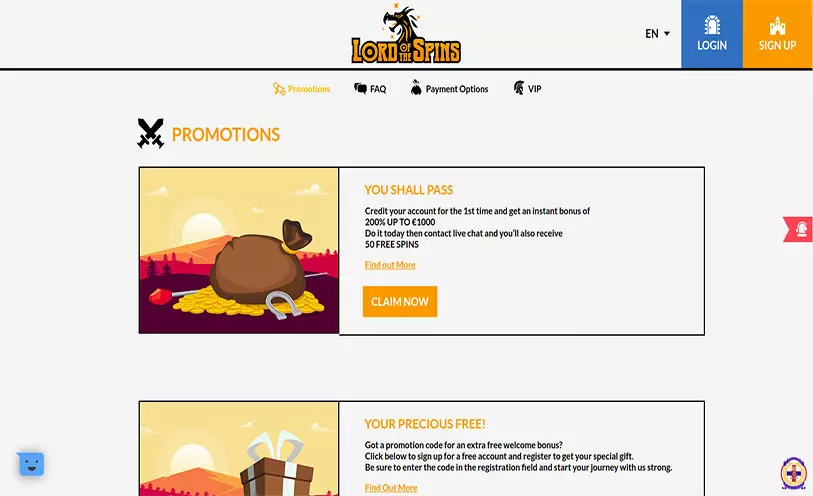

Based on items, either observed and you will verified first hand by reporter, otherwise stated and you can affirmed away from educated provide. Regarding no-set bonuses, they typically provides large wagering requirements compared to earliest bonuses. It means their’ll have to gamble on account of a quantity one which simply cash-out one to money. Although this may seem tricky, it’s still a powerful way to talk about the new gambling enterprise as opposed to and then make a first deposit. Welcome to NoDeposit.org, the newest acknowledged destination for the brand new zero-put bonuses and other fun advertisements.

Don’t use a personal protection number (SSN) otherwise personal taxpayer identity matter (ITIN) to your versions one inquire about a keen EIN. Submitting an application 940 with a wrong EIN otherwise using the EIN away from another’s company may result in charges and you will delays inside running their get back. In the event the in initial deposit is needed to be produced to your twenty four hours that isn’t a corporate day, the newest deposit is known as prompt if it is produced by the new close of one’s next working day. A corporate time is actually any date other than a friday, Weekend, or judge vacation. The word “courtroom vacation” to have deposit aim comes with solely those courtroom vacations on the Region from Columbia. Judge holidays regarding the Region away from Columbia are offered within the section 11 away from Pub.

These are the largest Pacific fish varieties for this reason it feel the keyword ‘king’ in their term. Queen fish real time to five years on the sea, some features resided to eight, they could build as long as cuatro.9 ft or more so you can 129 pounds. If you would like to attempt to amass a king fish the fresh spring season blend journey is best time for you is.

Once indeed there, it discovered few opportunities, and lots of remaining disappointed. Claimant is required to feel the identity and you may target of one’s person(s) whom sold the fresh energy to the claimant, the brand new times away from get, and you may, when the shipped, the desired proof of export. To possess states to your traces 10 and you may eleven, install a different sheet to your identity and you may TIN of any nonprofit educational team or governmental equipment to help you just who the fresh gas otherwise aviation energy are offered plus the number of gallons sold in order to for each. For says to your outlines 9d and 9e (kind of play with 14), attach a new sheet to your name and you will TIN of each and every political device in order to whom the fresh kerosene is offered and also the count from gallons ended up selling to each. The newest entered best seller of the kerosene offered for use within the industrial aviation is eligible to make it allege on condition that the brand new buyer waives its proper by providing the new joined biggest merchant with a keen unexpired waiver. Just one allege may be recorded for your gallon away from kerosene sold for use in the commercial aviation.

Enter the amount of premiums paid inside one-fourth for the regulations provided by international insurance firms. Multiply the brand new premiums paid back by the costs listed on Form 720 and you can enter the overall on the around three sort of insurance to the the new range for Internal revenue service No. 29. A tax borrowing from the bank could be advertised equal to the amount of income tax that was implemented on each tire which is sold on the or perhaps in connection with the original retail selling out of a nonexempt car said for the Internal revenue service Zero. 33. Allege the new point 4051(d) tire credit on the Schedule C, line 14a. Electricity utilized in an excellent fractional control program aircraft, while the defined less than, after March 31, 2012, are subject to a surtax of $.141 per gallon. The new fractional ownership system director is liable to your surtax.

Routine spends of the information tend to be offering it to the Department away from Justice for municipal and you will unlawful litigation, and urban centers, states, the fresh Area away from Columbia, and you will You.S. commonwealths and areas for use inside giving its tax legislation. We would along with disclose this informative article abroad lower than an excellent taxation treaty, so you can state and federal companies to impose federal nontax unlawful laws and regulations, or to federal the police and you can cleverness companies to fight terrorism. Inability to include this short article in a timely manner or taking not true otherwise fake information could possibly get subject one punishment. If you cannot afford the full amount of income tax owed, you can apply for an installment agreement online. You could submit an application for a fees contract online in case your full matter you owe within the shared tax, punishment, and you may interest try $twenty five,100 ($50,100000 for folks) otherwise quicker, and you filed all of the expected output.

LDWF giving short term commercial fishing subscription towns

However, tend to be all of the social protection and you can Medicare fees for such publicity on the Form 941, contours 5a and you can 5c (or Mode 944, outlines 4a and 4c). To possess Mode 943, include the public defense earnings and you may Medicare wages to your outlines dos and you will 4, respectively; and statement the newest personal protection income tax and you can Medicare taxation for the outlines step three and you may 5, respectively. Should your count taken care of an employee to possess premiums to your class-life insurance in addition to almost every other earnings is higher than $2 hundred,100000 for the twelve months, report the other Medicare Tax for the Function 941, line 5d (or Mode 944, range 4d). To own Setting 943, are the Additional Medicare Taxation earnings on the web six and statement the additional Medicare Tax on the internet 7.

Public ferry

Query new team to supply a finalized Function W-cuatro when they begin performs. A worker who had been repaid wages ahead of 2020 and you may which unsuccessful to help you furnish a form W-cuatro is to remain handled while the solitary and you may stating zero allowances to the a 2019 Mode W-cuatro. For individuals who deposited the required number of taxation but withheld an excellent smaller matter on the personnel, you can recover from the brand new worker the fresh personal security, Medicare, or taxes you placed for them and you may included in the fresh employee’s Form W-2. However, you need to get well the money taxes just before April 1 of the pursuing the year. To the Function W-dos, never consider box 13 (Statutory employee), as the H-2A professionals aren’t legal staff. Part 3509 rates are not readily available for those who purposefully disregard the needs to help you keep back fees regarding the worker or you withheld money fees yet not social shelter or Medicare fees.